Have you ever tried to Raise Your Credit Score and had no luck? Well, there is a system to raising your credit score, you just need to know how to do it. If you’d like to see those score numbers increase over time, use these 10 tips to your advantage.

What steps can I take to raise my credit score?

Paying your bills on time is one of the most important factors for improving your credit score. Additionally, reducing outstanding debt, avoiding multiple applications for new credit cards and loans, and checking your credit reports regularly are all strategies to improve your credit score.

Is it possible to raise my credit score with no money?

Yes, there are a few ways that you can raise your credit score without spending any money. For instance, you can dispute any inaccuracies on your credit report that may be lowering your score; this won't cost anything but may have a big impact on raising your score.

Related: Top 3 Important Debt Myths Debunked

How long does it take to see an improvement in my credit score?

The length of time it takes to see an improvement in your credit score depends largely on how much you owe and how well you manage payments. If you consistently pay off debts and refrain from taking out new loans or applying for additional lines of credit, you should see improvements within 6-12 months.

Are there any risks associated with trying to improve my credit score?

Generally speaking, no; however, it is important to make sure that any loan offers or products you take advantage of are reputable and not scams designed to exploit existing vulnerabilities in your financial well-being. Be sure to do research before jumping into anything that could put you further behind financially than before!

Tips to Raise Your Credit Score

#1. Reduce the amount of debt you have.

While debt isn’t always a bad thing, it can be a bad thing whenever you have too much of it. Make sure you keep your debt at a minimum. If you do have debt, pay it off as quickly as you can. Credit scores can go low when you’re bogged down with too much debt, especially if you’re not paying it. Try the snowball method to get more debt paid off at a faster pace.

Related: 7 Simple Tips to Improve Your Finances

#2. Monitor your own credit score.

Do you know what is awesome? When you can monitor your own credit score and see what may be bogging it down. You can use sites like CreditKarma.com to look at your credit score for free. Gone are the days you have to wait once a year to see your credit score. See if you have any derogatory marks and do your best to fix them!

#3. Don’t use up all your credit cards.

If your credit cards are maxed out, then we have a problem. You don’t want to have ALL your credit cards maxed out as this isn’t good for your credit report. Using up all your credit cards never looks good, so get them paid off. Try to keep your utilization low so that your available credit is higher than the balance you’ve spent on your credit cards.

#4. Keep your longest credit card open.

When it comes down to improving your credit card, don’t close the one you’ve had open the longest. Long credit history is important! So the longer you have a line of credit open, the better. Even if you’re not using the card as much, making a small purchase with it each month is a great way to keep it active and in good standing.

Related: How To Start Eliminating Debt

#5. Dispute any errors you can find on your credit report.

If you see errors when monitoring your credit, report them. If you’re seeing ghost debt on your report, you can dispute it. A ghost debt may appear when a new company buys an old debt. If it’s older than seven years and you haven’t made any payments on it since then, you may be able to get it removed from your credit report, ultimately increasing your score.

#6. Get some of your hard inquiries removed

If you have a lot of hard inquiries for cards that you weren’t approved for, you can contact Experian and Transunion directly and request to have those inquiries removed. If you don’t recognize the inquiries, it’s important to contact these credit agencies as soon as possible. The companies can take them off your credit report. Once a few of the hard inquiries get deleted, your score will improve.

#7. Negotiate with some of the debt collection companies.

If you have debt sent to collection companies because you couldn’t keep up with it, these derogatory marks can take a toll on your score. You may think you won’t get them removed because you can’t afford to pay the full cost of what you initially spent on those credit lines. However, most debt collection companies are willing to negotiate a price with you. It’s possible to pay off debt much lower than you initially owed. Some companies will even accept 90 percent of the original balance.

Related: How to Save Money – How to Save 50% of Your Income

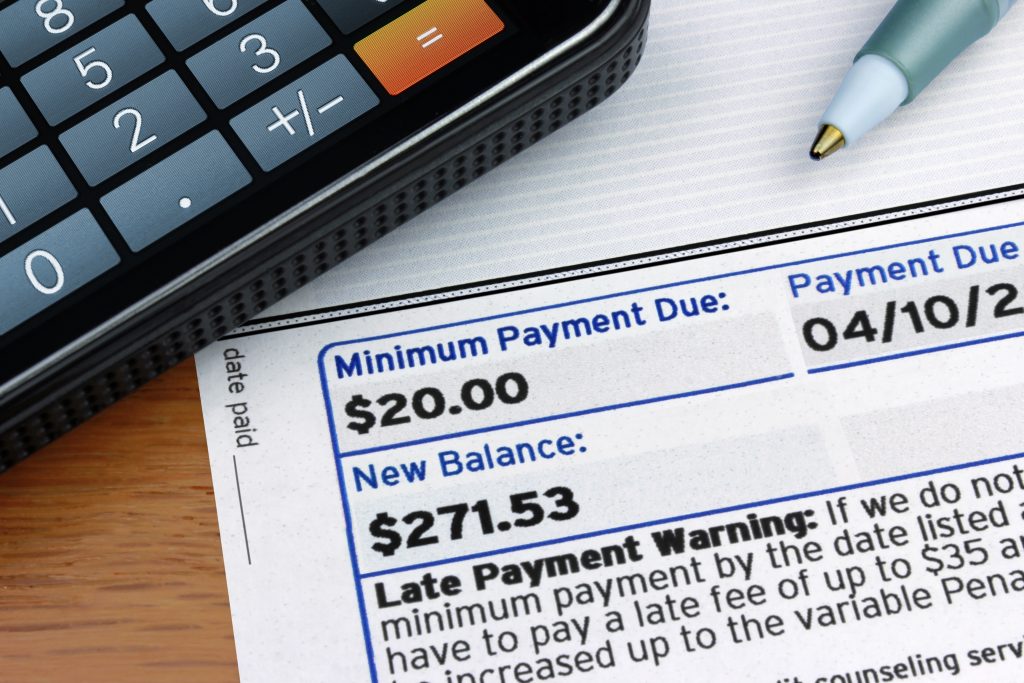

#8. Pay off some of your debt by the statement date.

When you have a credit card, you know that you’ll need to make a minimum payment by the due date. However, it’s the statement date that is more important for your credit score. Check the statement date for each credit card you have. Make a payment two days before your statement closes and reports to the credit bureaus. It will improve your credit score by a few points each time. If possible, make an additional payment by your due date just to pay the debt off faster.

#9. Apply for a new line of credit.

Sure, you might think applying for a new line of credit is bad because it’s a hard inquiry added to your credit report. It can knock your score down by a few points for a moment, but there is a good side to this. Once the new credit line appears on the credit report, your score will bounce back and increase to a higher amount than it was before. The reason the score increases is that your available credit increases, causing your utilization to drop since you have more credit available to you. Every time I have needed to open a card I always go with Capital One. They are the best, in my opinion, I even had a car loan with them at one time.

#10. Use the Experian Boost feature.

Experian offers a service that allows you to boost your credit score by making on-time payments for your utility bills, including the electric company and gas company. If you make these payments on time and would like to have them included in your report, you can sign up and take advantage of this convenient offer. Many people have managed to boost their scores by more than 10 points using this method.

Related: 25 Ways to Improve Your Budget This New Year

#11. Pay your bills on time.

Late payments can stay on your credit report for up to 7 years and have a big impact on your credit score.

#12. Don't miss payments.

Missing payments altogether can have an even bigger negative effect on your credit score.

#13. Reduce the amount of debt you owe.

Having too much outstanding debt can be a red flag when lenders evaluate your loan application and could lower your credit score.

#14. Limit credit inquiries.

Too many applications for new credit cards or loans in a short period of time can lower your score, so try to limit the number of inquiries you make in any given year.

#15. Check your credit reports regularly.

Monitoring your reports for errors or issues can help you catch any inaccuracies that might be lowering your score and give you an opportunity to dispute them before they affect your standing with creditors.

Raising your credit score is easy, but it does take time! Pay everything on time, limit your debt, and don’t reach the max on your credit cards. How are you raising your credit score?

Leave a Reply