Did you know that using cash instead of a debit or credit card can usually help you cut your spending? The reason behind it is that when you use cash, you typically pay more attention to what you’re spending than you do if you’re just swiping a card. Paying more attention means you spend less because you’re more aware of how much money you actually have.

How to Use the Cash Envelope Budget System

One of the best ways to manage this budget is with cash envelopes. The cash envelope budget is easy to set up, easy to maintain, and easy to see what you have left.

It’s also a fantastic way to see where you’re overspending and where you may be able to lower your budget because you’re underspending!

Don't forget you can also add money to your budget with things like earning free Amazon gift cards, selling your recipes, and even earning money from your car.

Related: 7 Forgotten Monthly Expenses You NEED To budget For!

Here’s how it works:

At the beginning of the month, sit down and figure out how much you have coming out for expenses and what those amounts are.

Then, you will pull whatever amount of cash you will need to cover your bills and other expenses.

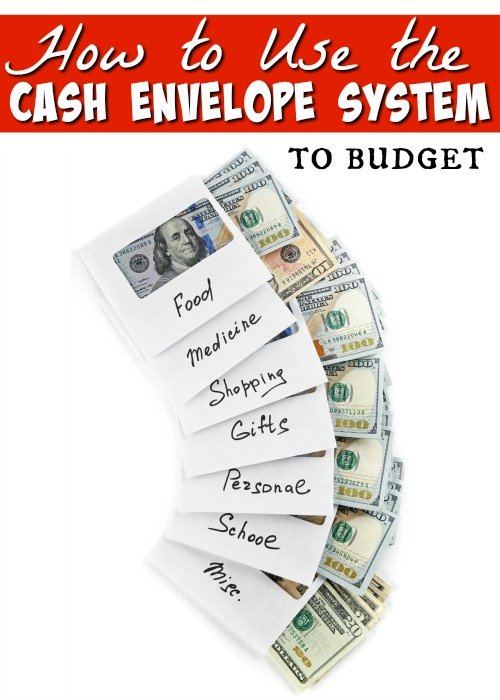

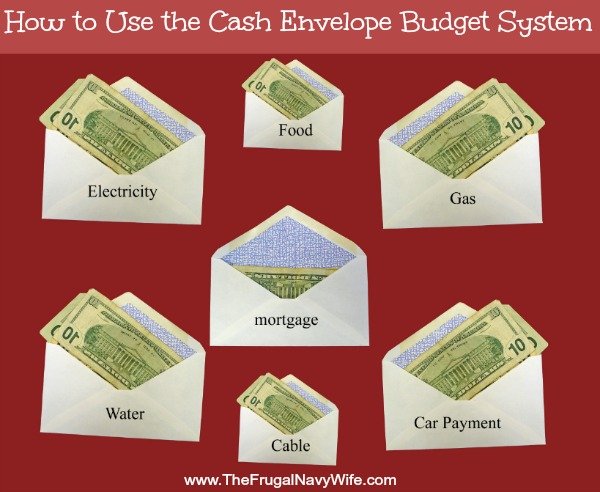

Each expense gets its own envelope. Write the name of the bill or whatever on the envelope.

Now, as you pay bills, you will ONLY remove cash from that specific envelope. If you’re buying groceries, you can ONLY remove money from the grocery envelope.

Once the money in that envelope is gone? It’s gone and you’re done spending money on that category.

Related: $100 Until Payday: The $100 Grocery Budget (or Less!)

It’s that easy! A couple of things about this budget though.

No moving money from one envelope to another. The idea here is to help get your spending under control. If you’re shuffling money around, you’re not controlling your spending in whatever category you have to keep feeding.

At the end of the month, if an envelope still has cash in it? You have two choices. Either roll that leftover cash to the next month (meaning it will take less out of your paycheck to re-fund it for the new month) OR put that money into savings. Either way, you’re saving money.

Looking for more ways to jump-start your savings? I highly recommend America's Cheapest Family's Book I picked up some amazing tips from them!

I sort of get the cash envelopes works. But my problems is by the time I pay all my bills in the first of the month I have no cash money left to put in the envelopes. I pay everything online that way it keeps me on track what bills got payed online bank. The only thing I can pull off is maybe getting the cash out for the gas and groceries but already broke by the time I get that part. I always pay the the online bills first before anything else. I believe this cash thing would work but don’t know where to start especially if you’re paying everything online to make a payment. Any help or suggestions ?? I would love to get out of debt for real !!!

I think you should try using Mint.com When my husband was in the military we were the same way. Mint helps you track where every penny is going. The first month i used it i saw we spend over $500 eating out and about died! I didn’t think we ate out that much. This will help you find you money leaks and also budget your paychecks 🙂

Vic, I can relate on wanting to get out of debt. What have you tried so far?

I don’t understand this Mint.com. You put all you info in and then what? Every time you send a dime log it in? I am retired I have automatic bill pay for my seven bills. So maybe I can envelope the rest of my money’s.

No it links to your bank account (view only mode you can’t transfer anything around). It then pulls every transaction for you. Then you categorize them to which budget they apply to you. You can set up rules so certain ones always go to a certain category (like gas station and grocery stores). It’s an automated envelope system. If you do auto bill pay then yes you can pull cash and do the cash envelopes for the rest fo you budget 🙂 That’s how we got back on track the first time.

Hi iv been really interested in the cash envelope system I live in ny and still find myself living check by check can’t seem to be able to put any money in savings it’s terrible I’m still a little confused with it would love to really learn how to go about it

And I also pay most of my bills online I’m leary about the mint.com iv been hacked twice and I’m afraid to put my info out there how does it work again so e how little wind up adding up ten when I turn around I’m broke before payday again it’s awful and o also get paid biweekly

I understand that but there is no way yo access your bank account, get your info, or move money from mint 🙂

I think this is a good system and I’ve heard about people using it and having a lot of success. It’s not realistic for a lot of people that don’t have the money in the beginning the month put in the envelope. If you’re living paycheck to paycheck there’s no way you could do this in the beginning of the month because you don’t have the money. What are the suggestions for people that are in that situation?

This seems like a lot of work, but I’m sure it would be effective if you really wanted to curb your spending. Interesting!

I do this! But I use paper clips instead of envelopes. I label the paper clips with what the money is for and amount. It works pretty well for me.

My husband and I tried this for a few months and it was just impossible. Especially since you have to pay almost everything online. It’s nice in theory though

I’ve never tried that system but sounds legit:) Everything that can help me to save some money is worth to try

I’m willing to try and work on how money works and how to make it work for me the right way . Wish me good luck m.m.

Hi Danielle,

I’ve talked to several people that have done this and the results have been amazing. Going from being in debt to $20k to $40k in savings in a year or two with no debt. It takes discipline and the hardest part is just starting but it’s worth it!

The cash envelopes system is for things you do or spend daily. You can still pay all your regular bills online. Like gas, groceries, personal, fun, medical (if you don’t have insurance, like me), anything that isn’t budgeted monthly really.

I kinda of do this, except me and my husband have 8 bank accounts.

Cheques and saving each, rent account, DD (bills), insurance (life,car,house)

& holiday.

When we get paid I move the money into each account,

Also my bank does a round up system. . . . . If I was to spend £9.50 they would round it up and put 50p into my sav8ngs, that quickly adds up.

I love the cash envelope system however I’m a bartender make cash daily paychecks aren’t worth much minimal pay any suggestions?

One option would be to put the cash you make into a jar/container then budget it out weekly. You would then need to do a weekly budget instead of monthly.