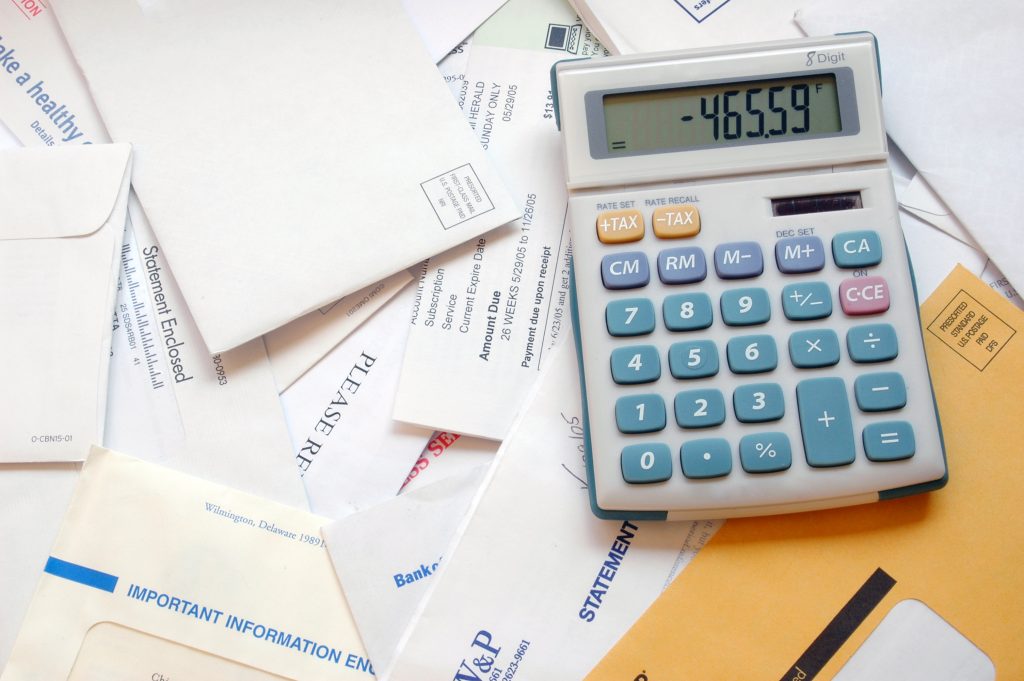

If you're like most people, you're on a budget. But have you ever considered the best type of budget to create? According to many financial gurus, a Zero Balance Budget helps people save more money and spend less. It's also one of the simplest budgets to make and you're probably already doing it without even noticing it.

What is a Zero Balance Budget?

A Zero-Based Budget is just what it says- your budget should equal zero at the end of the week or month, however far in advance you balance your budget. Whatever income you receive, and whatever out-going expenses you have, should all equate to zero, no matter what is thrown at you.

How To Make A Zero Balance Budget

Write your monthly (or weekly) income down on a piece of paper. Write your expenses down. Do they equal zero? If not, you have some work. If, for instance, you have $500 leftover after you budget your monthly expenses, you find a place for that $500. Do you have credit card debt? Pay it down. Do you have a savings account? You do now. Do not let that extra cash just sit there. This Free Monthly Budget form from Dave Ramsey is a great help.

Alternatively, if you end up with more outgoing funds than incoming, you need to scale back. Can you cut out eating lunch twice a week with friends until your debt is under control? That new pair of shoes isn't that essential, is it? Look at your basics that you must pay monthly (car payment, rent, insurance, cell phone, etc.) and then check out the extras (if you assign $200 a week for groceries, reassess if that's necessary). Find out where you can save money.

What's the Benefit of a Zero Balance Budget?

According to surveys, zero-based budgeters pay off 19 percent more debt and save 18 percent more money in the same amount of time as those who do not use this type of budget. This plan is simple and it shows you just where you can scale back and that you can pay off early. It can be done today and you can see a change in your finances at the end of the week.

Related: How to Build a Budget You Can Stick to This Year

Other Tips For Getting a Zero Budget

After you balanced the budget and did some trimming, did you still come up negative? Not sure where to cut out more expenses? Try these other tips:

Cut out eating out altogether. It can literally save you hundreds in a single month, which can help you get to a zero-balance budget AND pay off debt so that you can enjoy eating out in the future- when you're stress-free! Can't let eating out go that simply? Give these Frugal Dining Out tips a try.

Sure, your car is nice. But can you get a cheaper car? Check into trading in that gas-guzzling sports car for a cheaper model with better gas mileage.

Clip coupons and buy groceries on sale. Additionally, make a plan with your groceries as you do with your budget. NEVER go into a grocery store without a list and a plan. Try buying generic brand vs name brand to save more as well.

Do you need all of those cable channels? Or can you find a cheaper option? If you can cut this bill in half, you may be able to reach “zero” on that budget.

The biggest tip, though, is, to be honest. It can be very embarrassing to admit that you haven't been responsible for money and you are probably the reason you're still in debt. It happens to everyone, but by making a budget and becoming aware of where you can cut out expenses, you are taking a huge step to end the cycle of debt abuse.

Related: 25 Ways to Cut Your Spending by $100 a Month or More!

What To Do With Extra Money

Found yourself with extra money? Congrats! You may be in the minority, but don't go blow all that extra cash in a celebratory move. Find out where you are in debt and pay it off. Sure, you may be making triple payments on that credit card a month, but what about your car payment? Make an extra payment just three times a year and you will pay directly onto the interest, helping to cut it down over time. Whenever you have the chance, always pay off debt as soon as possible to save yourself even more money over the long run. Making a Zero Balance Budget can assist with that.

Leave a Reply